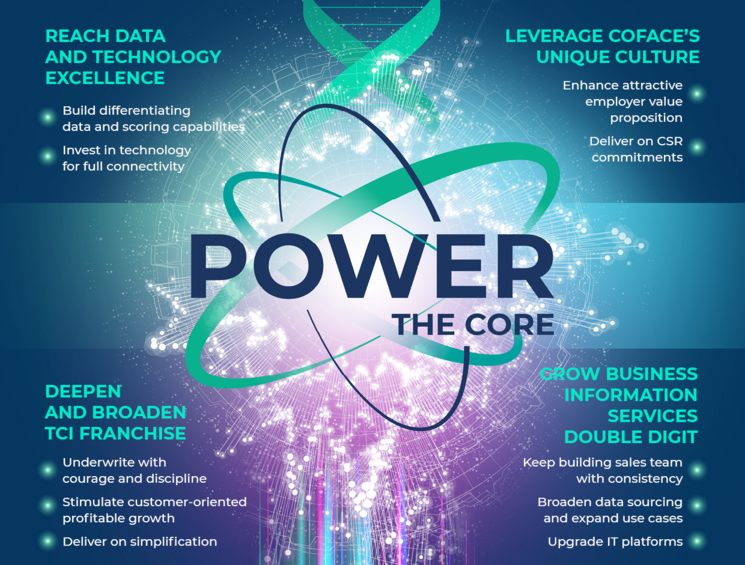

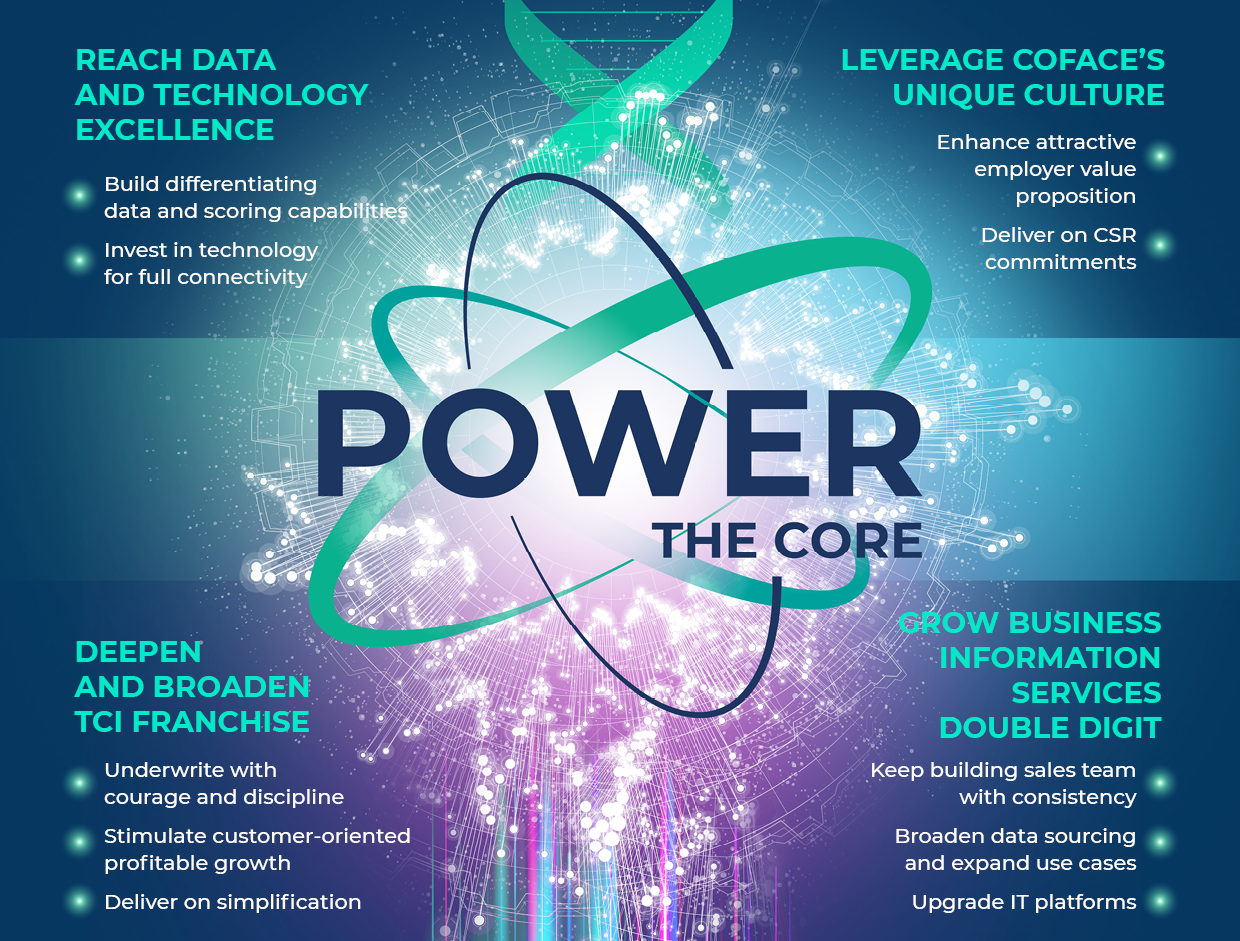

Power the Core strategic plan

Our Power the Core strategic plan builds upon the successes of previous strategies, Build to Lead and Fit to Win, with ambition to build a best-in-class global trade credit ecosystem. Learn more about what this means for our customers, employees, and other stakeholders.

Develop a global ecosystem of reference for credit risk management

Financial targets through the cycle

- Undiscounted combined ratio: ~78%

- RoATE* (Return on average tangible equity): 11%

- A solvency ratio towards the upper end of the range: 155-175%

- Payout ratio: ≥80%

- Business Information contribution to 2027 RoATE*: 0,5%

*At the current level of interest rate environment

Online services for customers and brokers

- Customer Portal - Cofanet

Customer Portal - CofaNet

Coface online platform for managing your trade receivables. Full monitoring of your risks. Direct access to all tools according to your contracts.

- Broker Portal

Broker Portal

Platform dedicated to brokers for monitoring your business and managing your customer portfolio (in all countries where legally available).

Innovative and digital solutions

- API Portal

API Portal

Stop juggling between software applications. Explore Coface API Catalogue and Integrated Solutions for Icon by Coface and trade credit insurance.